ICO (initial coin offering) was supposed be the new way to raise capital from ordinary people around the world. Without limitation, the method was to help startup companies to realize their ideas. Everything from renting houses and real estate to medical records should now be placed on the blockchain. Somehow, the token that the company sold during their ICO was later supposed to be used as internal currency in the future system.

But the fundamental problem with a company that has control over a blockchain is that it can not become censor-resistant or decentralized. Then, a traditional database solution would have been more appropriate.

After over a thousand ICOs, it is still difficult to list even a few products or services on the market where a token is actually used. The only area of use has so far been speculation.

Hard to find good information

If you want to make your own evaluation for a potential investment in an ICO, it is very difficult to find objective and critical information. What an inexperienced person may not realize is that anything you can see and read on the internet, in the form of articles and threads on forums like Reddit, is just marketing written by people who are already invested.

Various top lists, but also reviews on Youtube, are paid. There are even channels where important so-called influencers coordinate which ICOs to be reviewed next. Telegram is an important platform for ICOs and it is common with fake users and other things that create the impression that there is a lot of interest. It is also common that users get paid in tokens in so-called bounty programs to help spread the word in various social media.

If you invest in an ICO via a public website, you should expect to be the last one in the pyramid, the one who gets the worst price and probably also the one who will get dumped by others who bought the token for half the price or cheaper through more private channels.

Easy to create tokens

It’s easier than you think to create your own ICO. Because there are finished templates, a keystroke is sufficient to generate a new token on the ethereum network, which is the most common token platform. All you need is a website, a whitepaper and a big marketing budget.

The standard process is then to maintain a continuous flow of news and campaigns in social media to keep up the interest and influence the price in a positive way. All investors demand this. Examples of news may be that the project will do an “airdrop”, a “token burn”, undergo rebranding or advertise different partnerships with known companies or other ICOs.

As the ICO market is saturated, investors are turning to the most hyped ICOs in pursuit of quick profits. The fundamentals have become so absurd that, for example, it has become important that the ICO has the word “chain” in its name, that it promises thousands of transactions per second, that you have a well-known Youtuber that recommends it, and that you will be listed on a good exchange with a high trading volume. The crypto exchange Binance has been able to charge several million dollars this year to list a token.

Unknowing investors are pulled in

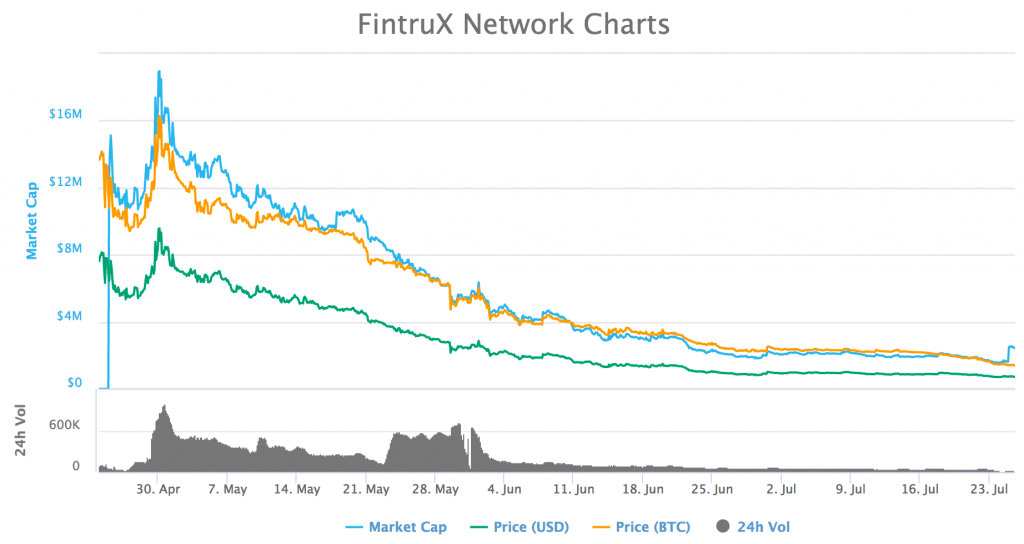

We have now begun to see figures that as much as half of all ICOs are shut down within four months of their launches, and more than half of last year’s ICOs have already failed. In fact, this is millions of dollars that more or less have been embezzled from unknowing investors who have been pulled in to the blockchain hype and the dream of quick profits.

As more regulations have come into place, it has also become impossible for ordinary people to even buy into an ICO before it reaches an exchange. To not classify ICO tokens as securities, they must not have a fundamental value or give a dividend.

Venture capital companies are the ones who have the opportunity to buy during private sales rounds at a discounted price, but then we are back in the same situation that ICOs were supposed to solve.

Simon Lindh,

Bitcoin enthusiast

—

Interested in sending us an opinion article? Mail us at [email protected].