All bitcoin experts are confident that the bitcoin price will go up in the long run. But why? There are modern cryptocurrencies that are better and safer, while fiat (regular money) increasingly replaces bitcoin in the trading pairs at crypto exchanges.

Even worse, a temporary dip in the bitcoin price may be fatal, especially for bitcoin cash. Bitcoin gold has recently been subjected to a so-called “51 percent attack”, which in short means that someone with much mining power can spend a smaller cryptocurrency like bitcoin gold twice.

What does a 51 percent attack cost? Not much at all.

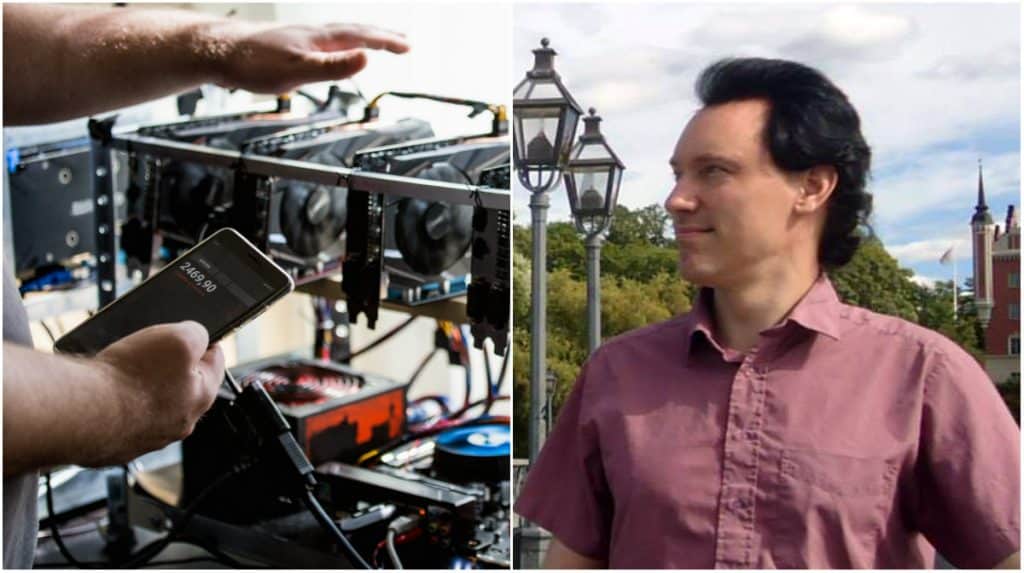

Bitcoin gold is extremely sensitive to such attacks because it is possible to rent mining equipment. But in the case of bitcoin and bitcoin cash, those who want to mine must first invest in ASIC (more expensive and efficient mining equipment). The problem is that the level of difficulty when it comes to mining has gone up even though the value of the reward that miners get has fallen sharply.

“The bitcoin system vulnerable in a completely new way”

In the end, it will not be worth having an ASIC, except for those who have extremely cheap electricity. Then someone can buy a lot of ASIC’s cheap and then just start them to complete a 51 percent attack. The easiest target is, of course, bitcoin cash where the hash rate (the network’s computing power) is much lower.

Also, note how the bitcoin gold price did not go down after the 51 percent attack. This is because the attackers shorted bitcoin gold to make money on the decline, in addition to making money on spending double amounts. Today, it is easy to sell crypto assets that you do not have on, for example, Bitfinex and many other trading venues, or on the US stock exchange Chicago mercantile exchange (CME).

So the combination of “proof of work” with ASICs, falling prices and a well-developed financial infrastructure make the bitcoin system vulnerable in a completely new way. For the first time, there is both sufficient financial incentives and tools to make the attack profitable.

“Difficult to justify the need for bitcoin”

The idea that bitcoin maximalists have had is that bitcoin should be used to secure other blockchains, but this has not happened and that is fortunate if I’m right.

On the other hand, there is, for example, Stellar that uses “proof of stake”, which means that it does not pay off to carry out attacks. This summer, both eos and iota are also starting to become “ready”, and they promise free, immediate and probably also private transactions, even in the form of stable coins that correspond to US dollars, euros or gold. Then it becomes very difficult to justify the need for bitcoin to free ourselves from the banks.

Miners of bitcoin, bitcoin cash, ethereum and the other “proof of work” currencies sell new coins for around $30 million a day. If they are abandoned, there might be a bull market for the rest of the crypto market because the investment money that is now paying the miners can instead increase the price of other crypto assets or start new development projects.

Henrik Wallin,

Crypto enthusiast

—

Interested in sending us an opinion article? Mail us at [email protected].