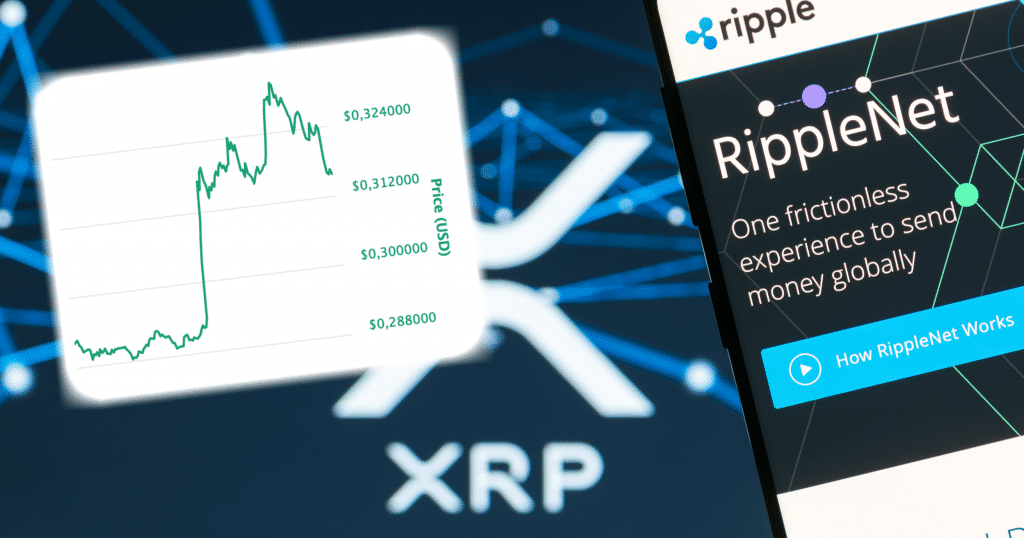

On Wednesday morning (CET), xrp was trading at around $0,289148. Then it took off.

Until Thursday night, the cryptocurrency peaked at around $0,332599. That’s an increase of over 15 percent, according to numbers from Coinmarketcap.

What exactly caused the rapid rise is, as usual, difficult to say, but here are some possible reasons.

New tech collaboration

On Wednesday, the Japanese financial services company SBI Holdings announced that it is initiating a collaboration with tech startup R3. R3 has previously raised money from well-known players on Wall Street such as Bank of America, HSBC and Wells Fargo.

SBI Holdings and R3 have now started a new company together in Tokyo, Japan. The news about the collaboration has been interpreted as positive for xrp because one of SBI Holding’s subsidiaries, a crypto exchange, recently announced that they support xrp. In addition, SBI Holdings has previously been in favor of xrp and the technology behind Ripple, Ethereum World News writes.

Also, the payment network Swift has revealed that they intend to test their “GPI link” with R3’s “Corda”, an open distributed ledger platform. This, too, has been interpreted by the market as positive for xrp since Corda has been accepting to Ripple’s cryptocurrency xrp, which has made some believe that Swift may soon be fully implementing Ripple’s technology, Ethereum World News writes.

Praise from IMF director

Another reason for xrp’s rally can be the positive words about Ripple’s technology from Christine Lagarde, managing director of the International Monetary Fund (IMF).

During a fintech festival in Paris recently, she praised cryptocurrencies and blockchain technology while warning the world’s banks for not keeping up with the progress fast enough.

“I think in the banking system at large in many, many countries, the difference will not be between those who are disrupted and those who survive. The difference will be between those who are cannibalized because they’re not seeing it coming, and they’re not embracing it, and those who self-induce that cannibalization”, Christine Lagarde said, according to Oracle Times.

Another news that was considered positive for Ripple is that the company recently sent a quarter of a billion dollars in xrp in two transactions – which only took a few seconds to complete, Oracle Times reports.