Ahead of bitcoin’s halving that occurred on Monday, many discussions have arisen in the crypto world about which model most accurately predicts the bitcoin price.

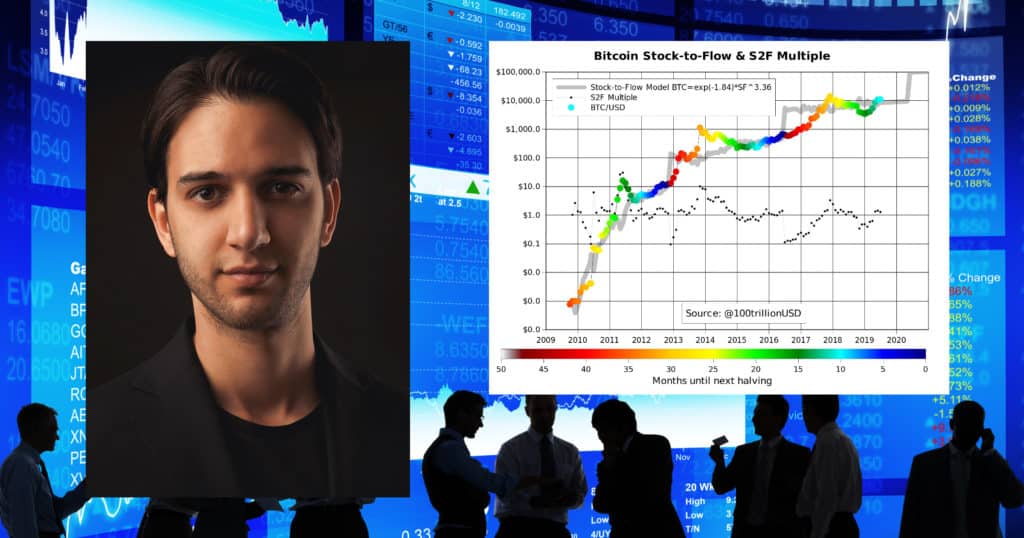

One of the most common is the so-called “stock-to-flow” model. It looks at the relationship between bitcoin’s market value and its scarcity.

The monetary inflation in bitcoin, which is regulated by the halving that occurs every four years, is shrinking at the same time as the market value historically has increased. The thesis for the “stock-to-flow” model is based on the fact that there is a statistically significant relationship there, and that the bitcoin price should therefore continue to rise.

The model was introduced in March 2019 by an analyst who goes by the pseudonym “Plan B”.

Criticism of the model

But not everyone is fond of this model. Eric Wall, chief investment officer at the crypto asset management firm Arcane Assets, is one of the critics.

He thinks that anyone should understand that bitcoin’s value is growing substantially in line with the popularity of cryptocurrency, not in line with a predetermined schedule.

“It’s a ridiculous theory, because the conclusion is that bitcoin’s price trend would be known in advance, programmed into the source code. Still, a significant portion of today’s bitcoin advocates and wiseacres have embraced the concept. It is almost impossible to discuss bitcoin’s price today without this model being mentioned”, Eric Wall told Trijo News.

Could be relevant

The reason why so many seem to believe in the “stock-to-flow” model is because it is, after all, more reasonable than almost any type of work of this kind that has been done before, says Eric Wall.

“The model is also presented as having been substantiated by sophisticated econometric methods. On the theoretical level, the model also has support, since it can roughly be applied to other types of assets such as precious metals”, says Eric Wall.

In a way, he thinks that the “stock-to-flow” model is even relevant.

“But the main thing for bitcoin in that regard is that there is a finite limited amount (21 million), not the current monetary inflation rate. In the intervening period, other factors such as demand play a more significant role. The theory is simply loosely motivated, but it is enough for some people”, says Eric Wall.